My IMG Journey

My profession is ECE. an OFW who spent ten years in Taiwan. As OFWs, our primary concentration is typically on investing—that is, making large purchases and then building houses for our families. We have absolutely no notion what IMG entails. Nobody explains things correctly, possibly because IMG did not exist when we were OFWs. More often than not, we will have to keep imagining and creating it ourselves. Additionally, my spouse was an OFW who first worked in the Kingdom of Saudi Arabia before moving to Kuwait. We "save" for the family with the same thoughts as me, but we're still unsure on how to properly construct our Solid Financial House. How did I acquire knowledge correctly? My kumare, a buddy of mine, introduces me to IMG. However, prior to that, we had a mutual interest in investments. To cut a long tale short, after learning about the idea, I ultimately made the decision to join IMG and take advantage of Kaiser, the first step toward constructing our stable financial house. without the approval of my spouse. Hehe!Hehe. We just disagree on certain aspects of that proposal, not because I wish to keep it a secret. After a while, I informed him that I was using my Kaiser Plan. I told him not to worry, I'll pay for it, even though I knew what remarks he would make. Oh. how...Naturally, I'll look for a means. In addition, I gave it to myself as a 50th birthday present. I am confident that I am safe and secure because I have a long-term plan. If something were to happen to me, my beneficiaries—my husband and my two daughters—would receive benefits from my policy. If I live a longer life, I won't have to worry about it because I would become a burden on my family. It took me four years to discover that IMG had a significant possibility waiting for me. I carry out the purpose and recognize the value of imparting financial literacy, particularly to overseas Filipino workers. No family will be left behind since everyone will eventually become financially independent, and financial education is not just a possibility but also a critical requirement for all Filipinos and their families

MISSION

To Build a new Financial Industry, where everyone is able to earn what the wealthy are earning by bringing the secrets of the wealthy to all.

VISION

To help create wealth for families To make a difference for families so there will be No family left behind.

It is a new concept in financial industry that assist people who want to help themselves building their financial foundation. Thousands and thousands of people from all walks of life across the globe have benefited from International marketing group Platform

-

Get educated in all aspects of personal finance.

-

Have access to hundreds of financial products and services.

-

Receive training and support to manage their money.

-

Save money on various products and services.

-

Earn commission by sharing their know how with customers

this fast growing industry.

Become an IMG Member and you will learn :

MEET OUR AMBASSADORS

KAISER HEALTHCARE

SHARON CUNETA PANGILINAN

Philippine Megastar

MANILA BANKERS LIFE

BOY ABUNDA

King of Talk

IMG FINANCIAL LITERACY

KORINA SANCHEZ ROXAS

News Anchor / Host

Financial Services and Solutions helping you build your Solid Financial Foundation for a total peace of mind.

INCREASE CASH FLOW

This is the most important one if you are going to build your solid financial foundation. No matter how badly you want to build your solid financial foundation if you are not capable you will just get hurt but don't worry every problem has a solution. Learn how to increase your income or cashflow to start and continuously build your finances. Here in IMG we have entrepreneurship.

HEALTHCARE

If you are a bread winner, head of the family or if you are the one earning for your family you should have Healthcare. It is your protection so that whenever you got sick you don't have to worry about the expenses at all because you prepare health card for your health protection. You can also monitor your health condition so you will prevent any critical illness.

INCOME PROTECTION

Most of us don't want Life Insurance coz we thought it doesn't help much since we died already before we claim the benefits. Yes it is not for us, it is for our families. So if you want your family to have the same lifestyle while you are earning and providing for them you must have a life insurance or income protection so that when you die too soon they are protected.

ELIMINATE DEBTS

Having debt is inevitable especially if we are just starting a family or if our income is less than our needs. That's why we need to increase our cashflow start saving and slowly pay our debts before we do investing because if you do investment first and you still have a lot of debts your money will never grow. Your investment grow but your debt gain interest

EMERGENCY FUNDS

Having an emergency funds is a must so when the need arises you will not withdraw any of your savings and investment. Being ready for an emergency will give you peace of mind

INVESTMENT

Investment will give us passive income so when the time comes that we are no longer capable to work we have our investment to support our needs.

Or if we want to retire early we can do so because we are prepared for it.

Invest early to grow more your money.

Watch 62 Benefits exclusively for members only

OUR FINANCIAL SERVICES AND SOLUTION

Click and Watch Our Recommended Financial Solution

ULTIMATE KAISER HEALTHCARE

Kaiser is far more than an HMO. While most HMOs cater to both group and individual accounts, Kaiser's product is geared to address the long-term health care needs of individuals especially after their employment and retirement years.

MUTUAL FUNDS

Mutual Funds are pools of money collected from many investors for the purpose of investing in stocks. An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings.

INCREASE CASH FLOW

Learn on how to save and build your financial success. Learn how to be your money manager. Learn how money works for you so you can never work for money anymore. Learn how to increase your income by being entrepreneur

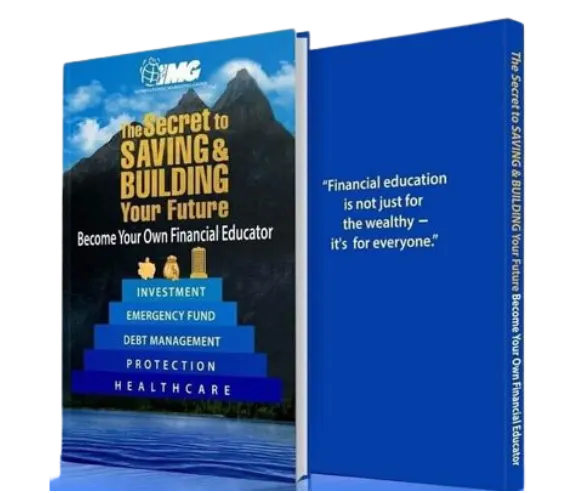

The Secret To Saving and Building your Future

Every day people go to work to make a living, but no matter how hard we work and how much we earn, money always seems to control us.

So many people are in debt. In rich and in poor countries, debt has become a way of life for many people throughout the world.

We don’t have much, and we don’t know much. Nobody teaches us how to manage our money in school.

Financial issues are not often discussed, and financial products not always explained. Even though the financial industry is one of the largest industries in the world, and even though we are flooded with financial news and websites, financial literacy is as confusing as ever.

Most people have trouble balancing their budget or reading a financial statement. We use credit cards and don’t always understand all the hidden charges. We want to have good health care and save for our retirement, but many of us do not have a plan.

We need to change, but we need understanding first. This book is helpful for people who want to move from financial insecurity to financial security. It is the first step toward a better financial future and possibly becoming financially independent.

By becoming your own money manager, you’ll discover that it’s doable to understand, plan, and build a financial foundation for your family.

You can do it. You can control your future.

See What Her Leader/Mentors Are Saying...

“Sis coach, you give something to aspired to others. thank you for always being coachable after 2 years in the making naconvince din kita gawin mission here in IMG & finally SMD kana.. Now evry single day you show us what excellence looks like. Congrats coach Dhez more power to you & your family hopefully marami pa tayo matulungan at maturuan how to save & invest the right way.. Soar high!”

GEM NUQUE

CEO-Marketing Director

“Coach Dhez is one of our relentless financial educator. She already helped many filipino families from all walks of life to save and invest correctly!”

AXE & GRACE ACUZAR

CEO-Marketing Director

What Her Team Mates Says

Here in IMG all coaches were really helping and motivating each other to do the mission

Coach Dhez is one of our relentless and amazing coach. She's doing the mission with her heart and doing it continuously though she's taking care of her sick mother. I was so inspired with her passion and dedication, easy to get along with and always ready and willing to help in every way she can.

MYE D. CERVANTES, AFP

Senior Marketing Director

Coach Dhez is a full time educator, very passionate in doing IMG mission. She’s also a relentless coach, a motivator and for sure she will build a Bigger Team.

JOSEPHINE PERDIDO, AFP

Senior Marketing Director

Coach Dhez or Ate Dhez is one of our relentless financial educator her in IMG. Who passionately share our mission of spreading the need for financial education to all Filipinos inspite of her responsibilities with her own family including her parents. If someone needs inspiration and motivation in reaching their financial goals/dreams in life coach Dhez is one of the mentors with a big heart that you can count on. God Bless everyone!

MAI AZUCENA

Senior Marketing Director

What her Members says

“Ever since I joined IMG, coach Dhez was the one who continuously guide me and taught me how to give importance of my hard earned money. I realized that instead of lending it to others that is too stressful on my part, I've learned to save it in a proper way. Truly IMG taught us the reason why we need to pay ourselves first before others."

Mary Ann Azur

“Being a single mom who is far away from her children is not easy. I am willing to sacrifice and do everything for them. Coach Dhez, as my mentor, helped me by introducing IMG. She guided me on the importance of building a Solid Financial Foundation. A proper way to save and prepare for our future. She enlightens me that everything is possible and that IMG is helping me to make our dreams come true.

Baby Lyn Wacayan

“It was when International Marketing Group introduced to me. A certain post catches my attention, that if I could still remember I commented like " is it the same with Sun Life Insurance? " That was when Coach Dhez sent me a private message. Invited me to join a Zoom Meeting that discussed the importance of Life Insurance. Though was not able to finished it due to my workloads, she managed to follow up on me. She patiently guide me how to share it to others too.

Judith Lopezillo

Be Inspired with these Success Stories

DR. JAIME LORENZO JR.

SEVC-Chairman Council

MALVIN AND CHRISTINE LEANO

Executive Vice Chairman

JESS FALLER JR.

SEVC-Chairman Council

YANMAR DEL ROSARIO

Senior Executive Vice Chairman

Click Watch more to watch more success stories to be inspired and motivated

Be Financially Literate

Attend Financial Class and Investment Webinar

(FREE 20,000 Personal Accident Insurance)

This Is A Limited Time Offer

-

Learn how to save and invest the right and easy way

-

Learn how to be your own money manager

-

Learn how money works for you

-

Learn about the formula of right saving

-

Learn how to increase your cash flow

Attend and Finish the Webinar to get your Free 20,000 Personal Accident Insurance

Your transactions are 100% secured.

DISCLAIMER: Please note that I am sharing my financial knowledge, resources, tools, and information that I thoroughly believe can make an impact into your financial life and help you plan and secured your financial future and be able to achieve your financial dreams. However, I can never be responsible nor guarantee you the exact result of this to you. Please know that your future still is in your hands and how you make control in your life. I truly care about you and your family's financial security that's why I am being real and absolutely transparent with you.

Ma. Lourdes Manalo. All Rights Reserved